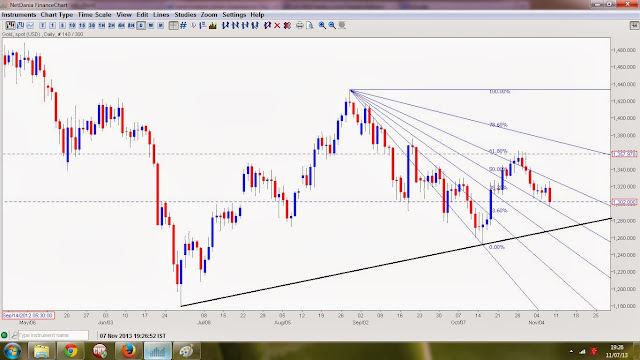

Silver

-- shaping up well for another leg down

-- making lower high on longer time frames

-- Strong support at around 18.20

-- Possible Targets towards $11.25 - $11.30

-- 40% move

-- Technically on longer time frame it have pending targets of $ 8.50 - 9

-- 10% chance of test of $ 4-5 range

#XAGUSD $SI_F

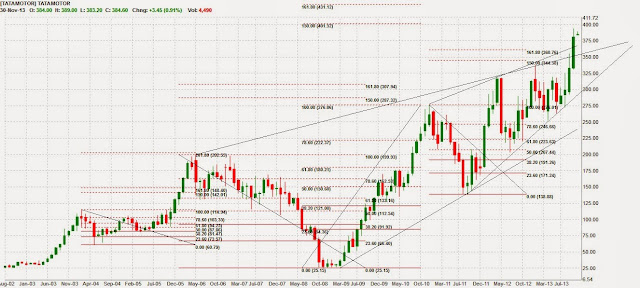

-- shaping up well for another leg down

-- making lower high on longer time frames

-- Strong support at around 18.20

-- Possible Targets towards $11.25 - $11.30

-- 40% move

-- Technically on longer time frame it have pending targets of $ 8.50 - 9

-- 10% chance of test of $ 4-5 range